Yesterday’s trading started out on a positive note, after Goldman Sachs (GS) reported a record-setting fourth-quarter and the European Central Bank took drastic steps to help ease liquidity concerns. Europe's Fed offered up $501 billion to banks after presented unlimited 2-week funding at 4.21%, a move meant to fill in end-of-year funding gaps at major investment banks. Meanwhile, in the U.S., the Fed proposed a set of rules to help keep subprime-mortgage history from repeating itself.

After a midday dive to the downside, the Dow Jones Industrial Average (DJIA – 13,232.47) settled for a gain of 0.5%. The DOW’s intraday progress was halted by resistance from its 20-day moving average.

The S&P 500 Index (SPX – 1,454.97) turned in a gain of 9 points by the close, with the 1,460 level providing resistance to the index's rally. The Nasdaq Composite (COMP – 2,596.0) rose 0.8% higher but it could not get up to 2,600 level.

I am still net short but looking to lighten up. We had a good day psychologically as the market could have just rolled over. We need another up day tomorrow to get past the resistance. We also need the FED to cut inter-meeting. They are just sitting around waiting to see if their efforts will psychologically stabilize the credit situation. To this point it has not worked.

Maybe this is wishful thinking but the “Credit Crisis” has hit the front page of the New York Times, this is usually a good contrarian indicator of a top or bottom.

Dow Jones Industrial Average (DJIA – 13,232.47) - support at 12,500; resistance at 14,000

S&P 500 Index (SPX – 1,454.97) - support at 1,400; resistance at 1,510

Nasdaq Composite (COMP – 2,596.0) - support at 2,500; resistance at 2,800

Wednesday, December 19, 2007

Recap 12/18/07

Posted by

prudentstockinvestor M.D.

at

6:55 AM

0

comments

![]()

Tuesday, December 18, 2007

Capital Preservation

Last Tuesday's Federal Open Market Committee meeting brought a rate cut, as everyone was expecting. Many - including myself - hoping for a more aggressive reduction of 50 basis points. We didn't get it, and the market was quickly punished. The next day, the Fed announced a plan where it and other central banks around the globe would pump money in to help with the credit-market fallout. After a sharp, and extremely brief early rally, stocks continued the rest of the week sharply downward. By Friday's close, the Dow Jones Industrial Average (DJIA) had given back 2.1% since the prior Friday, the S&P 500 Index (SPX) was off 2.4% for the week, and the Nasdaq Composite (COMP) had posted a weekly decline of 2.6%. Then over the weekend Greenspan reared his ugly head, talking about recession and possible stagflation. That killed the trade in Asia where all the bourses were down big. This translated to massive selling in Europe and then Americas.

Today, Goldman Sachs 4th-Quarter topped estimates but the beat did not buoy the shares, as they did not do their usual blowout. Still pretty impressive given the backdrop. BBY reported that third-quarter earnings rose 52% to $228 million, or 53 cents per share, compared to last year's $150 million, or 31 cents per share. Revenue for the quarter rose 17% to $9.93 billion. Analysts were looking for a profit of 41 cents per share. More importantly, Best Buy boosted its full-year earnings forecast to $3.20 per share from a prior guidance of $3.15 per share.

After the close last night, Adobe Systems reported that net fourth-quarter income rose to $222.2 million, or 38 cents per share, from $183.2 million, or 30 cents per share, last year. Meanwhile, revenue rose 34% to $911.2 million. Excluding certain items, earnings were 49 cents per share, edging past Wall Street's consensus estimate for 48 cents per share. Revenue was also above estimates for $887 million, according to Thomson Financial. Following the report, the shares dipped nearly 1% in electronic trading, but appear to have rebounded heading into the open this morning.

Shares of solar energy companies resumed their climb after dipping in Monday's session, as Lehman Brothers raised price targets on several names. Citing expectations that polysilicon, a key component of solar wafers, will continue to be in short supply, Lehman analyst Tim Luke raised his target on MEMC Electronic Materials to $110, from $90, implying he expects the stock to climb nearly 32 percent in the next year, from it's close at $83.42 Monday.

St. Peters, Mo.-based MEMC added $2.02, or 2.4 percent, to $85.44 premarket.

And shares of Epix Pharmaceuticals shot higher after the small biotech released study results for a drug to treat Alzheimer's Disease that it called "encouraging and compelling."

While the study was only two weeks long, investors didn't wait to bid up the Lexington, Mass., company's stock, pushing it higher by $1.70, or 57.2 percent, to $4.67 premarket, from its close at $2.97 Monday.

Economic Calendar

The economic calendar is all about real estate today, with the release of November's housing starts and building permits data. Wednesday's economic agenda is anemic, with the usual crude inventories the lone release. Thursday picks up, as the government will release the final Gross Domestic Product (GDP) report for the third quarter, as well as November's leading indicators, amongst others. Friday will end the week with November's personal income and spending reports, as well as the core Personal Consumption Expenditures (PCE) inflation data.

In August after a sharp rebound we went back down at around the level we are at know. This is a crucial psychological area. We need to keep going up from here to confirm this bull market. Real levels of support 12500 and 1400 on the DOW and S&P respectively.

Posted by

prudentstockinvestor M.D.

at

9:28 AM

0

comments

![]()

Friday, December 14, 2007

Money Flowing Towards Oil Services

Big Oil is on a spending spree in the Gulf of Mexico.

A couple of months, the oil companies of the world spent more than $300 million on 18 million potentially oil rich acres in the Gulf of Mexico. The U.S. Mineral Management service packaged the acreage, located off the Texas coast, into 282 tracts.

The big winner was British Petroleum, which scooped up 91 tracts and spent $31 million. The big spender was Norway's Statoil, which paid more than $138 million for 36 tracts.

The opportunity of giant fields in the Gulf drew 47 companies to the auction. This list is interesting because it includes some quasi-state owned oil companies, such as Statoil and Brazil's Petrobras. In fact, these two companies are relative newcomers to the Gulf of Mexico.

Neither company is new to offshore drilling, though. Petrobras is one of the world's best deepwater drilling outfits... and currently operates 40 offshore drilling rigs, primarily off the coast of Brazil. The company has a single rig drilling in the Gulf of Mexico, Rowan's Bob Palmer. Statoil operates 24 offshore rigs, but none in the Gulf of Mexico.

There's a great reason the Gulf of Mexico is getting all this attention. It's one of the few remaining regions in the world with huge potential, and is owned by a government that doesn't claim the oil. Quite the opposite, the United States embraces competition for the oil. Also there is little risk aside from Hurricanes, people wont be trying to take workers hostage like in Nigeria, and there is less political risk as well.

So why not by the big oil companies? You have to understand that these are huge projects and they long time to complete. It will take years for you to see a return on their balance sheets.

However, if you invest in the service companies that immediately benefit from these deepwater spending sprees you'll continue to see terrific returns over the next six months to several years. As Big Oil continues to spend that money, the service companies are going to be the beneficiary for years to come.

Some ways to play this field are ETF’s and stocks. The ETF (XES) and (PXJ) are a basket of stocks in the oil services sector. Large caps with good fundamentals include Transocean (RIG), Shlumberger (SLB. A smaller comapny the the former two and in my thinking the best pick is National Oilwell (NOV) the stock is the most undervalued in the group and is growing EPS at >20%. MID cap, best play is CAM excellent management and growth. There are some riskier smaller companies like FTI, GRP and FTK if some wants a smaller cap plays.

Posted by

prudentstockinvestor M.D.

at

12:26 PM

0

comments

![]()

Thursday, December 13, 2007

Profiting from Africa and The Middle East

The Middle Eastern markets are strong but it’s important to understand the Middle East is not just one market. It's 13 markets spread out over a huge space that takes many hours to fly over. And not all these places are driven by oil. Which is one of the misconceptions of the Middle East along with that its economy is highly dependent on oil and that if the price of oil drops the Middle East is doomed. For example oil only accounts for 3% of Dubai's GDP. It’s a fact that Dubai’s going to be completely oil dry in the next two decades.

Every market is different. In Morocco, the most important factor for economic growth is rain. In Egypt it's tourism. In Dubai, it's the nightlife.

And these economies are bigger than you might think. Taken as a whole, the Middle East is the eighth biggest economy in the world. On a per capita basis, Qatar, the United Arab Emirates, Kuwait, Oman, Bahrain, and others are richer than Russia, Brazil, and just about any other emerging market you can name.

There are incredible projects planned in the Middle East like the construction of the famous Palms and Globe (manmade islands shaped like a giant palm tree and a world map, respectively) and other surreal projects in Dubai. Dubai government to build a central utilities complex and cargo warehouse as part of Dubai International Airport expansion project.

The Middle East currently has more infrastructure projects planned than China and India combined. Saudi Arabia alone is planning 13 cities, not towns, but full cities the size of Dubai. And all of these projects are budgeted at $40 oil. Oil would need to fall more than 50% for these projects to be uneconomical."

You can't invest directly in most of these markets unless you're a citizen of the Gulf Cooperation Council. So most U.S. investors are out of luck. Also The Cooperation Council for the Arab States of the Gulf likes to keep its contracts and projects in-house as much as possible. In Saudi Arabia, 90% of businesses are privately held, family-run businesses. In Abu Dhabi, most of the city's largest developments are in the hands of a single development company, owned entirely by the government and answering directly to the crown prince. Contracts going to international firms are usually one-time (or, at most, two-time) deals. That’s why despite the calls of people like Jim Cramer, you can’t just buy Foster Wheeler or Halliburton to take advantage of this trend.

One way to invest is by using ETF, Symbol (GAF) State Street SPDR, but its mostly related to South African companies. The best way to invest by using the T Rowe Price Africa/ Middle East Fund (TRAMX).

Africa & Middle East Fund

Objective: The fund seeks long-term growth of capital by investing primarily in the common stocks of companies located or with primary operations in Africa and the Middle East.

Strategy: The fund expects to make substantially all of its investments (normally at least 80% of net assets) in African and the Middle Eastern companies. The fund may invest in common stocks in the countries listed below, as well as others as their markets develop:

Primary Emphasis: Bahrain, Egypt, Jordan, Kenya, Lebanon, Morocco, Nigeria, Oman, Qatar, South Africa, and United Arab Emirates.

Others: Algeria, Botswana, Ghana, Kuwait, Mauritius, Namibia, Tunisia, and Zimbabwe.

The fund is registered as "nondiversified," meaning it may invest a greater portion of assets in a single company and own more of the company`s voting securities than is permissible for a "diversified" fund. Depending on conditions, the fund`s portfolio should be composed of investments in about 30 to 40 different companies although the exact number could vary substantially depending on market conditions. The fund may make substantial investments (at times more than 25% of total assets) in the telephone or banking companies of various Middle Eastern and African countries. Stock selection reflects a growth style.

Estimated expenses:

Redemption fee 2.00% for shares held less than 90 days.

Management fee 1.06%

Other expenses 0.69%

Total annual fund operating expenses 1.75% (which makes it the highest expense ratio of any TRP International Fund).

Portfolio Management

Africa & Middle East Fund Christopher D. Alderson, Chairman, Ulle Adamson, S. Leigh Robertson, and Joseph Rohm. Mr. Alderson has been chairman of the committee since its inception. He joined T. Rowe Price International in 1988 and has been managing investments since 1986.

Posted by

prudentstockinvestor M.D.

at

2:11 PM

0

comments

![]()

Crossroads

At the end of November I wrote about the BPFINA as a contrarian indicator and it responded with a 12% gain in the financials until recently. I was hoping the FED would cut aggressively but they did not. Right now the market has to solve this on its own. The indicator is in no mans land at the time being. I was hoping for a positive reaction to Lehman Brothers Holdings Inc. (LEH) whose executives said they are optimistic they won't have to write down another $830 million on floundering fixed-income assets in upcoming quarters, despite a slowing economy. The financials are down by an average of 2.5%, this is a bad sign.

Next week Goldman and Bear report, we need some good reports to get the financials going again.

Posted by

prudentstockinvestor M.D.

at

1:57 PM

0

comments

![]()

Insider Buying

What a depressing day, or week for that matter, but according to a particular indicator things will get better.

The insider sales-to-purchases ratio was 13 in November. In other words, for every $13 corporate insiders took out of the market, $1 went back in.

I realize this doesn't sound terribly bullish, but remember that U.S. executives receive a ton of their pay via stock compensation. Stock options account for nearly half (48%) of CEO pay at Fortune 500 companies. So insider sales always outnumber insider purchases.

Because of this, anytime the sales-to-purchases ratio falls below 20, it's considered bullish... 13 to 1 is pretty bullish.

In dollar terms, insiders bought $297 million worth of stock in November. This isn't far off from the $330 million they bought in August before an 8% market rally. And in November, insiders only sold $3.8 billion worth of stock. That's the lowest November amount since 2002. But this is not a near-term indicator but forecasts 6 months down the road.

So in the middle of 08 the homebuilders, and financial stocks should be outperforming the other sectors. Along with this theme the basic materials should continue to boom to meet the new supply.

Look at the chart, its broken its downward trend if ever so briefly. But recently had a 20% move with a 50% retracement. Build a position for the next year, good entry point. Place stops slightly below the trendline.

EXAMPLES OF INSIDER BUYING

NVR

$52.4 million

Meritage Homes

MTH

$14.9 million

Brookfield Homes

BHS

$5.3 million

Pulte Homes

PHM

$150,000

KB Home

KBH

$93,000

Posted by

prudentstockinvestor M.D.

at

1:36 PM

0

comments

![]()

PPI: Futures

PPI came in hot, core was tame on a YOY. Retail sales and Jobless claims were bullish. The futures fell sharply after the release of data but since have gone the other way. At this time DOW looks to open down .5% as opposed to over a percent since 8:40am. So lets see where we go. Man this market is tough, it was a nice set up to cover a little and go long has now let us in nowhere land, now we have to be patient and find the lines to enter and exit. Looking for good entry points in my opinion is the difference between goo and bad trades. You can have a great stock but you have to enter it right to make good money. There are no flukes in the markets. The competition is just way too good.

Posted by

prudentstockinvestor M.D.

at

8:52 AM

0

comments

![]()

Pre-market Update

Futures are down big and we should open at about 70 points above the support level at the 13000 mark on the DOW (200DMA), this is a good point to lighten up on shorts and go long a little, and then sell any intra-day rally. Coincidentally, DXD ultrashort DOW ETF is at its primary upwave trendline resistance right at the open, if it breaks hard above 50, there will be more selling. However all this could change, all depends on the PPI and to a lesser degree on the Jobless claims.

The Bernanke strategy has backfired so far and until the market figures out what the FED is trying to do, stay away or stay short the DOW. I haven't really heard anyone except Brian Westbury come in support of the FED moves. Frankly, I don't understand what they did and the timing is an enigma to me.

Anyway, my job is to protect Capital at this point, and make small bets as I mentioned before.

Posted by

prudentstockinvestor M.D.

at

8:19 AM

0

comments

![]()

Wednesday, December 12, 2007

Bernake: I don't get this guy

Why could they have said something yesterday? He blows up the market, a lot of people bought pretection yesterday, including me. Shorts are going to get blown away at least at the open. There is no way to position your self with this guy. At see what happens at the close.

Posted by

prudentstockinvestor M.D.

at

9:20 AM

0

comments

![]()

Tuesday, December 11, 2007

Market Recap: The Fed Blows It !

Man is everyone disappointed big time. Bernanke has is head in the sand. I don't get this statement at all. We are going to a recession and this guy is worried about inflation. The cuts a drop in the bucket, we blew right through the swiss cheese supports and we are headed down to the 1370-1400 on the S&P. Furthermore, all rallies from here on in will be sell rallies till the subprime mess goes away. I am net short at this time with a 30% cash (as of this afternoon) and a couple of international plays to the long side, along with oil services. The financials got hammered, good thing I took some profits and bought insurance ahead of the FED yesterday and today, it helped a little but I tell I really don't like this market as much as I did before Bernanke dropped the hammer. I took a big hit today like everyone else who was long. Building short positions in any rally.

Posted by

prudentstockinvestor M.D.

at

5:48 PM

0

comments

![]()

Pre-market Update

Futures indicate a slightly higher to flat open. The Wholesale Inventories report for October will be released at 10:00 ET, but it won't have any impact as the market will remain preoccupied with the FOMC decision. The majority of people expect a 25 basis point cut in the fed funds and 50 basis point cut in the discount rate. I think aside from cutting rates the tone of statement they make is the key. They have to say we are worried about growth and not inflation and they will ensure the proper working of the financial system by ensuring liquidity. In corporate news, Texas Instruments (TXN) provided a mid-quarter update that raised the low end of its prior guidance ranges for earnings and revenue. Washington Mutual (WM) is getting slammed like Celgene's beat down yesterday. WM is cutting its quarterly dividend to $0.15 from $0.56 and will make an offering of convertible preferred stock in a bid to raise approximately $2.5 billion. Below is some more evidence to dispute talks of global slowing due to US slowdown.

Baosteel likely to inject assets into listed unit

Regency Energy to buy gas gathering system for $139 mln

Prudential Financial reports stake in Virgin Mobile

Airbus says Taiwan's China Airlines to buy A350

Janus Capital ups passive stake in National Financial Partners

Spain's FCC buys two U.S. waste treatment firms

UCBH completes acquisition of Shanghai bank

Absolut vodka maker to be sold via auction -govt

Cadbury sees 2007 sales growth beating its target

OMX Likely to Follow V&S Sale-Sweden's Odell

STMicro to buy Genesis for $336 million in cash

Miner Xstrata open to merger suitors - FT

Lacoste makes cash bid for Sweden's Gant

Shanghai Tunnel seeks Turkey, Mexico deals-source

Wacker Chemie to take over polymer joint ventures

UCBH takes "full stake" in Shanghai ban: WSJ

ArcelorMittal acquires Argentina's MT Majdalani

Shanghai Tunnel seeks Turkey, Mexico deals: source

Dubai's Istithmar eyes subprime hit U.S. firms

Posted by

prudentstockinvestor M.D.

at

8:49 AM

0

comments

![]()

Monday, December 10, 2007

Daily Market Recap

We started the day off with bad news very early this morning from Europe’s largest bank, UBS. The bank announced that it expects to record a $10 billion write-down for its subprime holdings and anticipates reporting a net loss for the fourth quarter versus its prior expectation that it would record a profit. UBS added that it was possible it could report a net loss for the full year. Then they reported the government of Singapore and a Middle Eastern investor would be making a sizeable investment in the bank.

Then came bad news from MBIA, it warned that its mark-to-market losses will be greater in the fourth quarter than in the third quarter. Fortunately, the market concentrated on the indication that private equity firm Warburg Pincus is going to strengthen MBIA, with a $1 billion investment. There was M&A activity as well, which created a positive tone as we (see below).

The Financials were up 2% today, have lead this rally (12% since bottom) and for this rally to be sustainable they will have to continue leadership. Along with the other bull markets to follow Oils and Gas exploration and services, Minerals and mining, Aerospace and Defense, and finally Tech cause they were the last to bottom.

Industry performance today: Bank +2.4%, Broker +2.4%, Housing +3.4%, REITs +2%, Coal +1.9%, Gold +1.7%, Trucking +1.6%, Chemical +1.5% and Oil Service +1.1%.

Technically: We have run nicely off last Tuesday's low has run in to some light resistance (1520 on S&P 500, 2724 NASDAQ Comp, 13750 and Dow) but mostly people are just nervous ahead of the FOMC meeting tomorrow.

In my opinion Bernanke has to lower rates by 50 basis points. He must also say that FED is more worried about the growth of the economy than inflation, and finally they must communicate that it wants to provide liquidity to ensure the proper functioning of the banking system. I am all in so I have nothing new to buy, see previous posts to see what I have been buying. All the positions except a couple are profitable except JCI (-3.4%) and PCR (-1.3%). MTL and VIP are up 28%, ITB up 21%, MDR and NOV up 11%, FCX and MTW up 9%, XLF 10%, OIH up 4% and BVN up 2.4%. I will take 1/3 of the table If FED does what I hope, and let the rest run into resistence hoping for pullbacks to buy.

If FED doesn’t go 50: Buying protection to the down side with close stops, it will soften the blow, buying some puts, DXD, SDS and QID ahead of the FED.

Posted by

prudentstockinvestor M.D.

at

4:44 PM

0

comments

![]()

PCR Update

This is from Zacks ROE Strategy, they posted today.

Perini Corp. (PCR) and its subsidiaries offer general contracting, construction management, and design-build services to private clients and public agencies worldwide. This is an excellent pick to round out our list of ROE heavy-weights with a reading of 32.4. The analyst community has been very bullish on the company lately, with three of four covering analysts raising current-quarter projections within the last 30 days. The consensus estimate has risen accordingly, growing by 13 cents to its current level of 73. Perini reported a great quarter on Nov 8, with net income jumping to $24 million from $9.6 million in the same quarter last year. The company boosted its full-year profit and revenue targets. Perini now expects profit of $3.30 to $3.45 per share on revenue between $4.4 billion and $4.6 billion. To round out the rosy outlook is Perini's price to sales ratio, which comes in at .35

If PCR closes below its 200dma, I am going to sell, this stock has been acting very poorly during this rally.

Posted by

prudentstockinvestor M.D.

at

10:24 AM

1 comments

![]()

Merger Mondays: Back Again

UBS writes down $10 bln, Singapore injects capital 8:17am EST

ZURICH (Reuters) - UBS revealed a $10 billion writedown and an emergency injection of funds from Singapore and the Middle East, making it the biggest victim of the U.S. subprime crisis to date among major European banks. Futuers are holding up so far ahead of the FED tomorrow.

Blackstone plans bid for Rio with Chinese: report 7:52am EST

SYDNEY (Reuters) - Investment group Blackstone is planning a counterbid for Rio Tinto Ltd/Plc with a consortium believed to include China's sovereign wealth fund, Britain's Daily Telegraph newspaper said on Monday.

Lafarge to buy Orascom Cement for $12.8 bln

Japan's Eisai to buy MGI Pharma

Reuters and Intl Herald Tribune sign content deal

Montreal, TSX exchanges to merge: report

Dun & Bradstreet says in M&A talks in China

Reckitt buys Adams cough treatments

Carillion agrees revised $1.2 bln bid for McAlpine Ads by GoogleWhat's This?

Wal-Mart plans 100th China store

Dec. 10 - The world's largest retailer eyes big sales in one of the world's fastest growing economies.

Posted by

prudentstockinvestor M.D.

at

8:33 AM

0

comments

![]()

Sunday, December 9, 2007

Weekly Recap 12/8/07

. The ISM's Index of Manufacturing Activity unexpectedly fell to 50.8 in November compared to October's 50.9.

. The ISM's Non-Manufacturing Index fell from 55.8 in October to 54.1 in November.

. The New Orders Index fell to 51.1 in November, a 4-1/2 year low.

. Productivity surged to 6.3% in the third quarter of 2007.

. Unit labor costs showed a 2% annual decline in the third quarter.

. U.S. Factory Orders rose by a strong 0.5% in October.

. Non-durable goods orders were up 1.3% in October.

. nonfarm payroll jobs report showed an increase by 94,000 jobs in November.

. Unemployment rate was at 4.7%.

. Michigan Consumer Sentiment Index fell to 74.5 from 76.1 , and second worst reading in the last 15 years.

. Consumer Credit increased at an annual rate of 2.3% in October, slightly faster than the previous month's gain of 1.6%.

Right now we are in a cycle of the stock market in which earnings and inflation are rising, while interest rates are falling. We are set up well technically for a move higher but the Fed has to cut rates aggressively to save the economy from recession. I think they will because the Bush is going to push Bernanke to do it. I don't care what they say in public, it's what happens behind closed doors that's relevant. Paulson, a smart market guy from Goldman Sachs is on the job (advising Bush). The President doesn't want to leave office with another negative on his record.

It will be a volatile next week, everything depends what happens on Tuesday.

Posted by

prudentstockinvestor M.D.

at

7:43 AM

0

comments

![]()

Friday, December 7, 2007

Top Movers Today

Price | Mkt Cap | Vol | $Vol | Popularity

Top movers Gainers Change Mkt Cap

LDK Solar Co., Ltd. LDK 13.19% 4.78B

Solarfun Power Hldgs C... SOLF 12.85% 1.24B

Sirona Dental Systems,... SIRO 12.58% 1.67B

DynCorp International ... DCP 10.90% 1.36B

JA Solar Hldgs Co., Lt... JASO 10.36% 2.93B

Losers Change Mkt Cap

Macrovision Corporatio... MVSN -21.35% 1.10B

Gemstar-TV Guide Intl,... GMST -16.56% 2.14B

FormFactor, Inc. FORM -12.79% 1.65B

StatoilHydro ASA (ADR) STO -11.56% 64.77B

SAVVIS, Inc. SVVS -10.31% 1.34B

Excludes stocks with mkt cap less than $1B. See FAQ

Sector summary

Basic Materials +0.58% Capital Goods +0.35% Diversified +0.30%

Cons. Cyclical +0.05% Cons. Non-Cyclical -0.24% Energy -0.75%

Financial -0.45% Healthcare +0.27% Services -0.24%

Technology +0.05% Transportation +1.17% Utilities +0.13%

Basically as I said this morning the rally is tired and need a new infusion of news. Very little volatility in the market, every time the bears tried to see the market someone was in there buying. Goldman came out with a very bearish call, basically saying we are already in a consumer lead recession and downgraded all the credit cards, AXP and the like got whacked. The Fed is the last hope for Santa rally to year end, lets see what we get. We need 50 basis points or 25 and 50 at discount window and a dovish tone in testimony or start shorting.

Posted by

prudentstockinvestor M.D.

at

4:37 PM

0

comments

![]()

Terex Corp

Terex Corp(TEX) manufactures equipment for construction, infrastructure, quarrying, mining, shipping, transportation, refining, and utility industries worldwide. It operates in five segments: Terex Aerial Work Platforms; Terex Construction; Terex Cranes; Terex Materials Processing & Mining; and Terex Roadbuilding, Utility Products, and Other. The Terex Aerial Work Platforms segment offers aerial work platform equipment, telehandlers, light construction equipment, and construction trailers. Its products include material lifts, trailer-mounted articulating booms, self-propelled articulating and telescopic booms, scissor lifts, construction trailers, trailer-mounted light towers, concrete finishing equipment, power buggies, and generators. The Terex Construction segment designs and manufactures off-highway trucks, scrapers, hydraulic excavators, wheel loaders, material handlers, pumps, gear boxes, and truck mounted articulated hydraulic cranes; and loader backhoes, compaction equipment, mini and midi excavators, site dumpers, and wheel loaders. The Terex Cranes segment provides mobile telescopic cranes, tower cranes, lattice boom crawler cranes, truck mounted cranes, and telescopic container stackers. The Terex Materials Processing & Mining segment manufactures and markets crushers, impactors, washing systems, screens, trammels, and feeders; hydraulic mining excavators; surface mining trucks; and drilling equipments.

Growth Rate 22.00

P/E (Price to Earnings Ratio) 9.97

Sales Growth of 15.00% per year

EPS (Earnings Per Share) $6.72 Sales (Yearly Sales - $Millions) $8,580.00

EY (Earnings Yield) 10.03 Market Capitalization - $Millions) $6,810.00

Stock has been drilled due to higher steel costs, steep US construction recession but aside from the US its doing well. Stocks bad news is in the stock price, its undervalued based on forcated earnings and sales growth. Tecnically stock forming a bottom and has support until 56. Currently its facing primary resistence at 68-69, its gotta get up past that to enter at this point until the 80's. I would sell it below 56 for a trade but it is a good long term play on global growth.

PS. for my friend Peter, the retailers are having a nice day. I'll put up the chart, next post.

Posted by

prudentstockinvestor M.D.

at

12:21 PM

1 comments

![]()

Home Builders

On December 4th I bought a small position in ITB, the Home Builders ETF. Well its up 16% since then, too much too fast who know, look at the chart, its breaking out. I know whole home building and construction industry in the US is in a recession, and everyone knows it. But you make money when no one wants to buy. That may be ending.

Posted by

prudentstockinvestor M.D.

at

11:55 AM

0

comments

![]()

Financial Sector ETF Short: SKF

As i mentioned a couple of days ago the SKF is breaking down after forming a bearish HNS pattern. Lets see if it can go to 75. I took the other side of that trade, the XLF which is the long trade earlier this week as previously mentioned.

Generally, looks unimpressed with the job numbers especially the revisions. At least the volatility has come down and this will let the skittish investors back in the markets to keep the downside limited. I am still long up to 14300-1400 on the Dow and all bets are off if we break below 1490 on the SNP. So with two big up days I guess we take a break til Tuesday.

Posted by

prudentstockinvestor M.D.

at

10:24 AM

0

comments

![]()

Thursday, December 6, 2007

Market Recap 12/6/07

Big Rally today with all the sectors up except a couple. We took a long time to get up above the 1490 on S&P. The markets sold off three times at the 1490 level and I thought we wouldnt make it today and that would have been a huge negative. So far my call has been right, and we will probably rally into Christmas or New Year unless Bernake messes things up, but I dont see us making new highs. 14300 was the last failure.

Last Change 52-Wk

USA (SPY) 150.94 1.43% 6.46%

Canada (EWC) 31.98 1.07% 22.39%

Japan (EWJ) 14.20 1.87% 1.43%

China (FXI) 195.74 5.92% 99.33%

S. Africa (EZA) 143.06 1.82% 27.85%

S. America (ILF)259.45 5.68% 54.80%

Singapore (EWS) 14.70 2.44% 31.37%

Taiwan (EWT) 16.17 3.45% 8.74%

Russia (TRF) 71.61 -0.68% -7.53%

India (IFN) 65.50 1.17% 38.19%

S. Korea (EWY) 68.39 3.75% 36.64%

Israel (ISL) 24.40 0.91% 32.03%

Last Change 52-Wk

S&P 500 1507.34 1.50% 6.54%

Oil (USO) 71.02 3.39% 31.79%

Gold (GLD) 79.37 0.94% 26.61%

Silver (SLV) 143.76 1.74% 5.94%

US Dollar 76.38 -0.07% -7.67%

Euro 1.464 0.18% 10.11%

VIX 20.96 -6.97% 85.98%

HUI 412.89 2.46% 15.94%

10-year yield 4.00% 0.09 -0.44

Last Change 52-Wk

Oil Service (OIH) 183.57 3.92% 24.89%

Big Pharma (PPH) 83.00 0.16% 8.78%

Internet (HHH) 61.75 1.15% 15.05%

Real Estate (IYR) 69.62 2.85% -19.25%

Financial (IYF) 99.15 1.91% -14.59%

Semis (PSI) 17.55 2.09% -1.74%

Healthcare (IYH) 72.78 1.17% 10.12%

Utilities (XLU) 43.95 -0.59% 19.04%

Defense (PPA) 23.43 0.47% 27.06%

Nanotech (PXN) 16.27 1.75% -7.82%

Alt. Energy (PBW) 24.63 1.90% 34.66%

Water (PHO) 21.45 1.66% 15.01%

Insurance (PIC) 17.96 1.53% -1.16%

Biotech (PBE) 19.49 1.56% 3.89%

Retail (PMR) 16.48 2.74% -15.66%

Software (PSJ) 20.38 0.99% 5.11%

Big Tech (QQQQ) 52.32 1.45% 18.21%

Construction (PKB)18.89 3.51% 12.11%

Media (PBS) 14.76 0.75% -6.52%

Consumer (IYC) 64.22 -0.12% -4.76%

Transport (IYT) 84.39 1.76% -1.96%

Telecom (IYZ) 29.64 1.61% 2.88%

Industrial (IYJ) 73.30 1.45% 12.15%

Basic Mat. (IYM) 75.50 1.67% 24.71%

Posted by

prudentstockinvestor M.D.

at

6:41 PM

0

comments

![]()

Dow at Resistence

LONDON (MarketWatch) -- The Bank of England cut its key interest rate by a quarter-point Thursday to 5.5% after economic data in the previous couple of days showed a sharp slowdown in consumer confidence and in services sector growth.

The rate cut is the first since August 2005 and comes after five hikes since August 2006.

There inflation rate is 2.1%, and they don't cut fifty. English Fed is worried about inflation, that for me is a negative. The futures were up nicely this morning before the cut and FTSE was up over a percent, its given up most of those gains.

It was looking like a nice setup earlier as we would have opened through the resistance. Keeping a itchy trigger finger today, cause I am all in and long.

Protect Capital at all cost.

Posted by

prudentstockinvestor M.D.

at

8:03 AM

0

comments

![]()

Wednesday, December 5, 2007

What is up with this Rally?

This is not a rally if we dont close higher than the Intraday highs. This would be a Faux rally. So here we are, the last trading hour and lets make a stand, I am long 100% for the first time in a while, but as RIMM (very negative reversal)sells off and averages are off their highs I am very nervous. The last 15 MINS are key for the bulls.

Posted by

prudentstockinvestor M.D.

at

2:54 PM

0

comments

![]()

MICROSOFT

If you are bullish like I am about TECH than the market can't go up without Mister Softee. Its up 3% today and has been lagging recently. It had blow out earnings and superb guidance stock hit 37, blew past 6 years of resistance, I am long MSFT.

PS. Santa, we need to close above 1490 on the S&P's.

Posted by

prudentstockinvestor M.D.

at

12:43 PM

0

comments

![]()

BEST WAY TO PLAY with CHINA

FXI, its up 74% for the year and going higher. Tell me what you think, a lot of people who have been to china, like Buffett, not Jimmy Warren think its going gangbusters and going higher. I was there last year, and let me tell you, I have not seen anything like the expansion going on there. I love China, CEE and ME & AFrica, and Brazil.

Posted by

prudentstockinvestor M.D.

at

10:56 AM

3

comments

![]()

RIVERBED

Hey tell me whtat you think, I have taken a beating on calls, I bought them a couple of days after they reported. I think its trying to stabilize tell me what you think.

P/E (Price to Earnings Ratio)

38.12

Sales (Yearly Sales - $Millions)

$193.00

GRT (Growth Rate)

46.00

Mkt Cap (Market Capitalization - $Millions)

$1,967.00

EPS (Earnings Per Share)

$0.73

EY (Earnings Yield)

2.64

Posted by

prudentstockinvestor M.D.

at

10:42 AM

0

comments

![]()

SVT: Speculative

Servotronics, (SVT) Servotronics, Inc., together with its subsidiaries, engages in the design, manufacture, and marketing control components and consumer products primarily in the United States. It operates in two segments, Advanced Technology Group (ATG) and Consumer Products Group (CPG). The ATG segment offers servo-control components, which convert an electrical current into a mechanical force or movement. Its principal servo-control components include torque motors, electromagnetic actuators, hydraulic valves, pneumatic valves, and similar devices for the commercial aerospace missile, aircraft, and government related industries, as well as medical and industrial markets. This segment also produces metallic seals of various cross-sectional configurations. The CPG segment offers various cutlery products for use by consumers and government agencies. Its products include a range of kitchen knives, such as steak, carving, bread, butcher, and paring knives for household use and for use in restaurants, institutions, and private industry; and pocket and other types of knives for hunting, fishing, and camping. This segment also offers machetes, bayonets, and other types of knives primarily for military use, as well as provides various cutlery items consisting of specialty tools, putty knives, linoleum sheet cutters, and field knives. The company sells its cutlery products under the brand names ‘Old Hickory’ and ‘Queen’ to the hardware, supermarket, variety, department, discount, gift, and drug stores.

Forget the consumer side the growth is in defense tech! Stock was more than a double this year and next year is also bright.

EY (Earnings Yield) 8.50 P/E (Price to Earnings Ratio) 11.75

EPS (Growth Rate) 17.00 Sales Growth 50.00% per year

EPS (Earnings Per Share)$0.99 Mkt Cap ($Millions)$22.00

Posted by

prudentstockinvestor M.D.

at

10:19 AM

0

comments

![]()

Perini Update

PCR had a significant move yesterday. with double the volume and no news, this is a tell my friends as this stock blew through resistence and is going to make new highs is the markets stay stable. VIP looks great, have had big gains in PCR, BVN, NOV, MTL and MDR:

http://custom.marketwatch.com/custom/tdameritrade-com/html-story.asp?guid={0AAF7CBC-DA0B-442C-99FA-50BD8D40C39F}

http://custom.marketwatch.com/custom/tdameritrade-com/html-story.asp?guid={39244ebd-70b1-4fa0-8f25-57d50b076937}

Closed my Amazon Dec call with a 44% gain.

Cramers wrong about MOLY, at least how to play it. FCX is the right way!

http://custom.marketwatch.com/custom/tdameritrade-com/html-story.asp?guid={56ae7718-4a89-4c61-92f5-adf074d9e5cd}

Whats troubling in this rally is the XLF is weak, thats not good, I think the techs have bottomed and we should rally the rest of the week if we close higher than the mid day point.

Posted by

prudentstockinvestor M.D.

at

9:39 AM

7

comments

![]()

We need to close up 300 points

Take out resistence on big volume or take your profits and run or cut your losses. S&P has to get over 1490 for us to rally. and we gotta blow past 13570 or we are in trouble

Posted by

prudentstockinvestor M.D.

at

9:30 AM

0

comments

![]()

FREEPORT Mc MORAN

Can I hear you say Double Bottom?

With a PE of 9 and a growth rate of 27 this stock is dirt cheap and was unfairly whacked. I have owned it and sold it since 2003, but I should have just held it. This is another great opportunity the Market gods have given us to enter this stock.

The stock chart shows it clearly bottomed and there has been no real fundamental change in the business of this company, at least that been reported. ECONOMIC WORRIES, GLOBAL SLOW DOWN, HEY its not Halloween its XMAS for god sake go buy stuff.

PS. Thanks Toronto Dominion for the RIMM Upgrade.

Posted by

prudentstockinvestor M.D.

at

8:51 AM

0

comments

![]()

Tuesday, December 4, 2007

RIMM is Killing me

I am down about 5% in two days on RIMM, the stock was up 2 bucks early in the day and now its down three bucks and thats not good. So there is going to be more downside with RIMM, but I can take the pain. I bought at 107 ans 106 and 102, and I am 100% in but if it trades lower I will buy up til 98. I have no EGO (at least that what I tell myself)

Posted by

prudentstockinvestor M.D.

at

3:03 PM

5

comments

![]()

Stock Market Update: 12/4/07

Well as I wrote on last Friday The Markets could be down on Mon and Tue, well they are. But What I really wanted was a back end rally on Tue, why we are not rallying in disconcerting. If we dont turn this around then I will have to re-think my stance on the markets. People are just waiting for the British FED and the the JOBS report and the folks trying to make more money on downgrades (shorts), just playin their games, the analysts the SEC has to look into this. People go short in the same shop, then they have their guys downgrade stuff, they make money on the way down and then they buy on the cheap. then upgrade and make more money. This has been going on for years.

Posted by

prudentstockinvestor M.D.

at

2:57 PM

0

comments

![]()

SETH TOBIAS

I didn't know Seth but I thought him a good guy from what I saw on his many appearances on Cable. Who knows what his personal life was like, that's a subject for God. I don't know how he passed, but people are slamming him and that's a shame. As a physician there is really no reason for anyone to die at such a young age if drugs and alcohol are not involved. Unless, he had a congenital heart problem, severe atherosclerosis of his Coronary vessels or a dissecting Aorta to name a few things to cause sudden death.

To me, the guy made a lot of money and partied hard screwed up or worse he was whacked. In any case as a person who has lived through lifes ups and downs and somehow survived I sorry he is gone, even if i never knew him personally.

Posted by

prudentstockinvestor M.D.

at

11:01 AM

0

comments

![]()

ITS TIME FOR USO

Its time to start a position in oil, USO ETF is a great way to play oil. USO is right at its 50 day moving average and has all the funde's behind it, so technically and fundamentally its sound.

Posted by

prudentstockinvestor M.D.

at

10:37 AM

0

comments

![]()

What I Want for XMAS

IS to be right about the upcoming rally. I think we rally right now to the end of the year, and you know what. I am all in. I sold my short position this AM. I am long Global ETF's QLD, RIMM, VIP , BVN, PCR, ATW, and have calls in MER, CRNT, RVBD, YHOO, XLF, AMZN, VRTX, MSFT, INTC, FCX, MDR, MOS, POT, SNDK and finally shameful as it may be, I bought the ITB. Ok, I know the homebuilders stink in terms of FUNDE'S, but I think its time to build a position.

Thanx for listening Santa

Posted by

prudentstockinvestor M.D.

at

9:59 AM

0

comments

![]()

I LIKE RIMM: MATE

I told you yesterday the downgrade on RIMM made no sense (wall street) they do this crap to get the stock down, I hate the analysts. The are worth ten times less than the shoes they wear and why are they even employed. Why should you care what they say? Why?

KEEP THE INFO AND GIVE IT TO YOUR BIG ACCOUNTS, thats who should care.

BOUGHT RIMM YESTERDAY and BUYING MORE WITH BOTH HANDS (See intraday chart over the past few sessions)

http://custom.marketwatch.com/custom/tdameritrade-com/html-story.asp?guid={3D6B5FE9-767F-4337-8BE6-8D896EA4A13F}

Posted by

prudentstockinvestor M.D.

at

9:40 AM

0

comments

![]()

SKF: Short Financials

Check out the head and shoulders formation on this baby. This is the ETF for people who want to short the Financials. Its up big, check the chart but its forming a head and shoulders pattern and maybe I see this cause iI am long the XLF, wishful thinking?

Posted by

prudentstockinvestor M.D.

at

9:20 AM

0

comments

![]()

Where is Ben Shalom?

Do you know what I want for Chanuka Ben. A rate cut.

I don't get it, these guys know how bad it is out there, there have been multi billion dollar right downs by the major banks, so many mortgage houses have shut down, hedge funds gone under and Ben is fiddling while Rome (US) burns and his Fed friends like Bill Poole don't care. What are you guys waiting for, more bad news; it’s already late in the game or does Countrywide have to go out of business first. Albeit it’s not his fault. This mess was created by Alan GreenSputum, please excuse me but not only couldn’t understand him, I can’t stand him. Why is this guy still alive let alone writing and speaking? He kept raising rates till the economy blew up. And then he kept cutting and cutting and caused the housing bubble. When he was approached regarding lending standards he didn’t see the problem with the ARM's. The guy is a genius.

Like I posted on Friday, we ran into resistance so technically we have go down a couple of days to set up for a healthy rally. So far the downside i have predicted correctly (futures down this morning), we'll see about the upside. Last August, we did not go straight up to the old highs. So today we have to wash out the weak holders early in the session and then late in the trading day I hope to see the pro's put money to work. I hear there is a huge position in Money Market accounts right now, that’s got to come into the market but we need a catalyst and I don’t know where its going to come from. The news of government helping homeowners could not spur the markets, maybe the bank of England will ease on Thursday and there is the jobs report on Friday. Not much hope until 12/11/07.

Cut the rates now not on the 11th (just wishful thinking).

Posted by

prudentstockinvestor M.D.

at

6:12 AM

0

comments

![]()

Monday, December 3, 2007

Joe Battipaglia: I can't believe this guy

Joe Battipaglia is now a PERMA BEAR, I am sick of seeing him of Kudlow and Co. has this guy ever been right? NO! I don't know if you remember him he was PERMA BULL of the Tech Implosion and for the entire bear market. He was always on TV. Mr. Battipaglia made 44 media appearances in the second half of 2000 alone, making 128 recommendations. Only ONE was actually a sell. He recommended the sale of Philip Morris on September 7, 2000. THAT WAS A GREAT CALL, EH?

I think he's trying different things to see if can get it right. He goes on CBS Marketwatch.com, below is an excerpt .

He now of Stifel Nicolaus says it doesn't matter what the Federal Reserve does with interest rates, "it still means the economy is going to go through a very rough period of time" that hasn't yet been reflected in the stock market. "I do see downside risk in stock prices of anywhere from 5-15% from current levels," says Battipaglia, "and that may evidence itself through December, or it may come on after we get through December." Battipaglia says he wouldn't be surprised if the powers-that-be decide next year that we're in a recession. "The real definition for us is when you have a marked slowdown in output and employment and consumption," he says, "and isn't that what we're going through right now?" This is the same Joker who was bullish all through the tech bubble, you believe this guy.

Here are some of his most famous calls:

December 1999: Joseph Battipaglia, market analyst

"Some fear a burst Internet bubble, but our analysis shows that Internet companies account for only 7% of the overall Nasdaq market cap but carry expected long-term growth rates twice those of other rapidly growing segments within tech." (The Internet Index lost two-thirds in the next six months.)

7/10/00-growth in corporate earnings will once again become the primary catalyst for lifting equity values. In this regard, I expect the higher earnings growth profile of the Nasdaq composite to deliver the best performance and provide leadership for the broader market.

7/17/00-The strongest growth category should remain technology with year-over-year gains in excess of 30 percent.

Fundamental conditions are such that profits for the second half and next year have the potential to remain well above the historic trend line.

I recommend that growth investors remain fully invested at this time. I am making no change in my year-end index targets of 12,500 on the Dow Jones Industrial Average, 1,650 on the S&P 500, and 5,500 on the Nasdaq composite index.

7/31/01-investor focus should to give way to greater investor enthusiasm as the potential for an extended profit cycle well into 2001.

8/21/00-Again, the fundamental conditions for a continued bull market remain very much intact

8/28/00-The next catalyst for higher equity prices should be strong earnings growth in the second half and the potential for an extended profit cycle well into 2001.

10/11/00-it is unlikely that the NASDAQ composite will reach my year-end target of 5,500. Therefore, I am reinstating my originally forecast target of 4,300 for the NASDAQ composite index by year-end.

I am leaving my S&P 500 and Dow targets at 1,625 and 12,500, respectively....analysts and investors will become increasingly comfortable with forecasts for top line growth, profitability and improving backlogs.

I see no significant threat to the ongoing expansion of the U.S. or global economies.

the balance sheets of households, government and corporations continue to show improvement as assets and income rise relative to obligations. At the same time, years of increased investment spending by corporations will have long lasting effects in raising productive capacity, efficiency and long run profitability for most companies.

10/23/00-My initial estimate of next years profit growth is for a 14 percent improvement in S&P 500 operating earnings over this year's....should help support rising equity prices.

I believe that the worst of the correction is now behind us and remain committed to my year-end targets of 4,300 on the NASDAQ composite, 1,625 on the S&P 500 and 12,500 on the Dow Jones Industrial Average.

10/30/00-Having reviewed the third quarter data, I am maintaining my 3 to 3 1/4 percent growth assumption for the U.S. economy in 2001 based on continued growth in consumption, rising investment spending by business, improved export business and growth overseas.

My earnings forecast remains for 14 percent growth in S&P 500 operating profits next year. I remain over-weighted in the following sectors: pharmaceuticals, financials, communication services and equipment, technology, and consumer cyclicals. I am making no adjustments to any index targets at this time. My year-end index targets remain 12,500 on the Dow Jones Industrial Average, 1,625 on the S&P 500, and 4,300 on the NASDAQ composite.

11/6/00-my forecast remains for relatively strong growth of 14 percent in operating earnings - somewhat higher than the annualized growth rate of the 1990's.

My year-end index targets remain 4,300 on the NASDAQ composite, 12,500 on the Dow Jones Industrial Average, and 1,625 on the S&P 500.

11/13/00-PC manufacturers are the most recent victims of these worries as competitive forces and margin pressures take their toll. This, however, is not indicative of an end to the spending cycle for technology.

11/20/00-Once the election decision is in place, the positive fundamentals will once again take center stage for investors.

12/4/00- I believe that the Federal Reserve will lower rates in the coming months as they did in 1995. One, perhaps two, 1/4 point rate cuts likely by the end of the first half of 2001

The environment for equity investors is favorable in light of lowered expectations on earnings that can easily be exceeded and my forecast for credit easing by the Federal Reserve. Valuations also have become more attractive when measured relative to their forward price to earnings ratios.

Accordingly, I am initiating my 2001 year-end price targets on the various indices as follows:

Dow Jones Industrial Average - 12,700

S&P 500 - 1,650

NASDAQ composite - 4,300

I expect to hear from a "kinder, more gentile" Federal Reserve board when it meets to discuss the future of monetary policy

to read them all to to: http://www.capitalstool.com/joe-battipaglia.htm

Posted by

prudentstockinvestor M.D.

at

4:03 PM

6

comments

![]()

Profit from Gaming

While the gaming stocks have run up and are very expensive, Perini Corp is dirt cheap.(PCR) Perini Corporation is also involved in construction management, and design-build services to private clients and public agencies worldwide. It also offers general contracting; pre-construction planning; and project management services, including planning and scheduling of the manpower, equipment, materials, and subcontractors required for a project. The company operates in three segments: Building, Civil, and Management Services. The Building segment provides services to various markets, including hospitality and gaming (big project with MGM City Center), sports and entertainment, educational, transportation, healthcare, biotech (R&D Centers), pharmaceutical, and high-tech. The Civil segment specializes in public works construction and the repair, replacement, and reconstruction of infrastructure, primarily in the northeastern and mid-Atlantic United States. This segment also offers contracting services, including construction and rehabilitation of highways, bridges, mass transit systems, and wastewater treatment facilities. The Management Services segment provides construction, design-build, and maintenance services to the U.S. military (In Iraq and Afghanistan) and government agencies, as well as surety companies and multi-national corporations

Perini Corp. said on 11/8/07, third-quarter earnings more than doubled as revenue rose more than expenses. Net income jumped to $24 million, or 87 cents per share from $9.6 million, or 36 cents per share, in the year-ago period. Revenue rose 60 percent to $1.24 billion from $773.3 million. Analysts expected profit of 67 cents per share on revenue of $1.11 billion, according to Thomson Financial.

Perini said the higher revenue and profit came from "the conversion of our substantial building segment backlog into revenues and profit." Building is the largest of the company's three segments, which also include civil and management services units.

Uncompleted construction backlog declined to $7.8 billion from $8.5 billion at the end of last year. The company boosted its full-year profit and revenue targets. Perini now expects profit off $3.30 to $3.45 per share on revenue between $4.4 billion and $4.6 billion. The previous estimate had net income at $2.80 to $3 per share and revenue at $4.1 billion to $4.3 billion. Analysts expect earnings of $3.10 per share on revenue of $4.31 billion. Company has a earnings growth rate of 27%, sales are growing at 61% and has a PE of 14 therefore I believe its extremely undervalued.

The stock has sold off the day after earnings each of the last three reports, its trying to stabilize at the 200 day moving average, which looks like a cheap entry point.

Posted by

prudentstockinvestor M.D.

at

3:02 PM

0

comments

![]()

Benefit From The Agriculture Boom

The prices of all kinds of meat are up. So is the price for cereals – Kellogg's and General Mills have raised their prices. Orange juice, eggs, and milk – all up significantly. You see it perhaps most prominently in higher prices for corn and wheat. Wheat recently reached an 11-year high. Corn topped a 10-year mark last year.As a result, once forlorn places such as Iowa are hot. Eager investors lurk about like bag snatchers at a railway station. They are looking to scoop up farmland. It's no wonder since running a farm is a good business again. Take a look at the chart below of average gross profit per acre (U.S.).This prosperity spills over to related industries, like a freshly poured lager that overruns the sides of a beer mug. Agricultural equipment makers are sopping up some of that prosperity, too. Farmers need tractors. They need tires for those tractors. They need irrigation equipment. Basically, anybody who sells anything to farmers is doing all right. Including the makers of fertilizers.World population growth is still putting more demands on food production. Then there is increased prosperity in China and India and other parts of the world. The result is more people with more money in their pockets. And these people want to eat more meat. That stimulates grain production even more. More grain production means more fertilizer use.Global grain stocks were already low two years ago. Remarkably, they are lower now:Forecasts call for grain inventories to reach their lowest level in modern history by the end of this crop year. Grain production should reach a new all-time high this year at 1.66 trillion tons. (Drought conditions throughout much of the U.S. don't bode well for this forecast, by the way). Yet demand is growing faster, to about 1.68 trillion tons. In three of the last four years, demand has topped production and grain stocks have fallen.Another big factor in all of this is the rush for biofuels – in particular, ethanol. Ethanol production should devour about one fifth of America's corn crop. The rush to plant corn is a great boon for fertilizer makers. Corn alone accounts for about 40% of U.S. fertilizer use. Plus, many farmers have dropped the standard corn-soybean crop rotation in favor of continuous corn planting. If you don’t believe this just look at the charts of these stocks: MON, TRA, POT, DE, MOS, CNH, AG, CF and other in the fertilizer, farm machinery and related industries for 2007. If you don’t want to buy all these to benefit from the trend in the years to come, you can check out DBA and MOO.

Posted by

prudentstockinvestor M.D.

at

2:04 PM

1 comments

![]()

Whats up with NAT GAS

This is setting up nicely to go long around the 33.30 level. all comments are appreciated on this or any other material on this site.

Posted by

prudentstockinvestor M.D.

at

9:19 AM

0

comments

![]()

RIMM downgrade: Not so fast

RIMM gets hammered on Friday, and today we get another downgrade. I just love this wall street game. Lets get the little guy frightened out of the stock and we'll buy it cheaper, 109 is a great level to get back in, if I can get in here its a great place to start, and as the panicked small investors sell I will buy more hopefully lower. This company rocks in-terms of sales and margins. I think the move they made with China's Mobile carrier was huge. The stock is down 27 bucks and unfairly.

Look at the chart, its got to hold the 109 long term up trend line (support). I think it will, but again I will react to this as the day unfolds since I don't have a crystal ball.

Posted by

prudentstockinvestor M.D.

at

9:03 AM

0

comments

![]()

Prudent Stock: 12/3/07

(MDR) McDermott International, Inc., through its subsidiaries, operates as an energy services company worldwide. It operates in three segments: Offshore Oil and Gas Construction, Government Operations, and Power Generation Systems. The Offshore Oil and Gas Construction segment engages in the front-end design and detailed engineering, fabrication, and installation of offshore drilling and production facilities; and installation of marine pipelines and subsea (where the real growth is at) production systems. It also provides project management and procurement services. The Government Operations segment supplies nuclear components and provides various services, including uranium processing, environmental site restoration services, and management and operating services for various U.S. Government-owned facilities, primarily within the nuclear weapons complex of the U.S. Department of Energy (this is an undervalued component of their business). The Power Generation Systems segment designs, engineers, manufactures, constructs, and services utility and industrial power generation systems, including boilers used to generate steam in electric power plants, pulp and paper making, chemical and process applications, and other industrial uses.

MDR has shown a consistent and predictable history of financial performance but their last quarter showed some slowing in the growth rate, they missed the quarter and the stock got hammered. This was an over reaction in my humble opinion because the stock had more than doubled YTD. This was coupled with the decline in the OSX and slowing world wide economic growth caused a precipitous fall in stock price. Its current EPS is $2.89 per share, and has a forecasted earnings growth rate of 27.00%, and a current PE of 18.

Given the companies forecasted earnings per share, forecasted earnings growth, profitability, given current interest, and inflation rates the stock is undervalued on a growth to PE ratio. If you look at the chart the stock has bounced off its long-term up-trendline nicely, so it looks good technically as well and is a good time for me to start accumulating.

Posted by

prudentstockinvestor M.D.

at

8:44 AM

0

comments

![]()

Saturday, December 1, 2007

Stock Market Week In Review: 11/30/07

Fed Chairman hinted at further interest rate cuts.

Gross Domestic Product was revised up to 4.9% in the third quarter of 2007. Downward revision to new home sales in July, August and September, new home sales inched up 1.7% in October.

Home builders cut prices by 13% on a year-over-year basis.

Existing homes sales in October fell 1.7% to an annualized 4.97 million units, 8th straight monthly decline.

U.S. Construction Spending surprisingly fell a hefty 0.8% in October, another fallout of the crumbling housing market.

Orders for big-ticket items fell 0.4% in October, following a 1.4% drop in September and a 5.3% plummet in August.

Personal Income increased at a seasonally adjusted rate of 0.2% in October as compared to the previous month.

Personal Consumption rose by 0.2% as compared to the previous month, the weakest rise since June.

Chicago's Purchasing Manufacturers Index rose from 49.7 in October to 52.9 in November.

Jobless claims jumped by 23,000 in the week ending November 24th to 352,000, the highest reading since early February.

Posted by

prudentstockinvestor M.D.

at

1:14 PM

0

comments

![]()

About Me: Disclaimer

Blog Archive

-

▼

2007

(68)

-

▼

December

(45)

- Recap 12/18/07

- Capital Preservation

- Money Flowing Towards Oil Services

- Profiting from Africa and The Middle East

- Crossroads

- Insider Buying

- PPI: Futures

- Pre-market Update

- Bernake: I don't get this guy

- Market Recap: The Fed Blows It !

- Pre-market Update

- Daily Market Recap

- PCR Update

- Merger Mondays: Back Again

- Weekly Recap 12/8/07

- Top Movers Today

- Terex Corp

- Home Builders

- Financial Sector ETF Short: SKF

- Market Recap 12/6/07

- Dow at Resistence

- What is up with this Rally?

- Dow Rolling over

- MICROSOFT

- BEST WAY TO PLAY with CHINA

- RIVERBED

- SVT: Speculative

- Perini Update

- We need to close up 300 points

- FREEPORT Mc MORAN

- RIMM is Killing me

- Stock Market Update: 12/4/07

- SETH TOBIAS

- ITS TIME FOR USO

- What I Want for XMAS

- I LIKE RIMM: MATE

- SKF: Short Financials

- Where is Ben Shalom?

- Joe Battipaglia: I can't believe this guy

- Profit from Gaming

- Benefit From The Agriculture Boom

- Whats up with NAT GAS

- RIMM downgrade: Not so fast

- Prudent Stock: 12/3/07

- Stock Market Week In Review: 11/30/07

-

▼

December

(45)

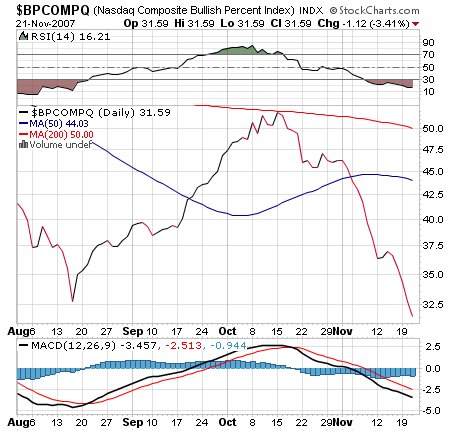

$BPCOMP

Extremely Oversold

Regarding Chart: BPCOMQ

Bear-ly Hangin" In dustrials

Dow Graph: 11/20/07